Payment Via Internet

E payment is a subset of an e-commerce transaction to include electronic payment for buying and selling goods or services offered through the Internet. Generally we think of electronic payments as referring to online transactions on the internet, there are actually many forms of electronic payments. As technology developing, the range of devices and processes to transact electronically continues.

Phases in E-Payment

An electronic payment typically involves the following phases:

1. Registration: This phase involves the registration of the payer and the payee with the issuer and acquirer respectively. Most electronic payments designed require registration of payers and payees with their corresponding banks so there is a link between their identities and their accounts held at the bank. 2. Invoicing: In this phase, the payee obtains an invoice for payment. This is accomplished by either browsing and selecting products for purchase from the merchant’s (payee’s) website in case of purchases made through the internet or obtaining an electronic invoice using other electronic communication medium like email. This phase typically is performed in an unsecured environment and normally excluded while designing payment protocols. The importance of this phase is that, it sets the mandatory and optional data variables that should be included in a payment protocol.

3. Payment selection and processing: In this phase the payer selects type of payment, (card based, e-cash, e-cheque, etc.,) based on the type of payment the payee accepts. Based on the selection, the payer then sends the relevant payment details like account number, unique identifiers of the payer to the payee along with accepted amount based on the invoice. Certain protocols might also require the payer to obtain preauthorised token (like bank drafts) from the issuer before the payer sending the payment information to the payee.

4. Payment authorisation and confirmation: In this phase, the acquirer on receiving payment details from the payee authorises the payment and issues a receipt containing the success or failure of the payment to the payee. The payee based on the message may also issue a receipt of payment to the payer

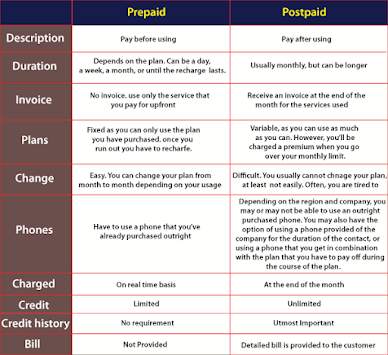

What is a Prepaid Payment System

Prepaid, as the name suggests, is the service for which you have to pay in advance. Every telecom provider in the country has plenty of prepaid plans and add-ons for their users. Any prepaid user can choose any of the prepaid plans that fit their requirements and recharge with add-on packs such as data add-on if their prepaid plans aren’t sufficient.

What is a Postpaid Payment System

In a postpaid connection, users are provided with services by the cellular providers and are then asked to pay the bill at the end of the billing cycle. Just like prepaid connections, users can also choose from multiple postpaid plans provided by their operators. Their postpaid bill will come under the plan they have chosen as well as their consumption.

Third-Party Payment

Third-party payment processors, or 3rd party payment systems, are processors not affiliated with specific banks or merchant services providers that give your business the ability to accept transactions without needing to get your own merchant account.

These are also known as payment providers and sometimes payment gateways, although they shouldn’t be confused with “online gateways”.

Common examples of third-party payment processors include:

The Emerging Methods of Payment SystemsConsumers want checkout processes that work as fast as possible and help them avoid long lines. Businesses that adopt these systems can increase sales, reduce costs and boost profits. Some of the biggest emerging payment methods include the following.

Contactless Credit Cards

Credit card companies constantly expand what they do for customers, and that includes the new contactless credit cards. They will soon replace cards embedded with the EMV chip that makes purchases more secure (although contactless cards still have chips). With a contactless card, a customer simply taps a card on the register, and the purchase is processed. But retailers must have the right equipment to allow contactless cards to work.

Payments With Mobile Devices

Mobile apps increasingly account for a higher percentage of sales in the United States. Much like contactless cards, consumers tap their phone to pay via the internet. Both mobile device and contactless credit card payments are secured through advanced encryption. In some cases, people might have to give their fingerprint or enter a passcode.

Some of the most popular forms of mobile app payments include:

- Digital wallets such as Apple Pay or Google Pay

- Quick Response (QR) Code payments have been adopted by stores such as Dunkin’ Donuts, Dollar General, Walmart, Starbucks and Target

- Mobile Banking allows people to transfer funds with apps such as Venmo or Zelle

Wearable Technology

While still a smaller segment of the electronic payment processing industry, wearable technology continues to grow. Examples include FitBit Pay, Apple Watch, AmazFit, and Kerv Ring. These payment methods have especially become popular at large events, such as music festivals, and at amusement parks.

Biometric Payment

Visa has launched a biometric payment card pilot program that uses fingerprint recognition rather than a PIN or signature to authenticate a cardholder for a transaction. According to Visa, “The cardholder enrolls the fingerprint, which is securely stored on the card. When he or she places the finger on the card’s sensor during a transaction, the card senses whether the scanned print is the same as the print stored in the card. A green or red light on the card indicates a successful or unsuccessful match.”

Comments

Post a Comment